The Price is Right

Have you ever agreed to do something for a particular price – and then immediately regretted it? I know I have, and I know I’m not alone!

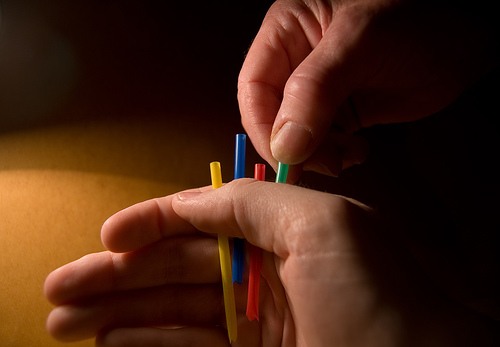

Just today, I had two conversations with self-employed clients and friends who were in a bit of regret about “underpricing” themselves. Wanting to make their customers happy, they had made themselves unhappy. They had traded their services for cash, and had given themselves the short straw of the trade.

Whether you own a business, work a job, or or invest in various relationships, organizations or causes, you are constantly “trading” your energy for something else of value. Maybe you trade your time for dollars with clients or an employer; maybe you’ve traded your career for the chance to be a stay-at-home parent.

No matter the situation, it can be hard to ask for what we want in the trade. And sometimes, we betray ourselves by asking for less than we know we’re worth.

Know Thyself

It’s important to know your “regret price” when pricing your time or services. (Mikelann Valterra refers to it as your “Resentment Number”). Include not just your time for doing the project, but the commuting time it might take. And don’t forget the time you spent marketing to get the client!

At what price will you resent yourself for doing the work? (I almost said “resent the client for paying you so little,” but really, it’s your choice to take the work or not.) Alternatively, at what price will you regret not doing the work, if they choose to hire someone else? It’s important to feel good about your price.

Think of your possible pricing in tiers (from high to low):

The “Reaching” Price

Feel GREAT Price

Feel Good Price

Bottom Line Price

Regret Price

Your “Reaching Price”: You’re not confident about the value, you might even feel guilty and wonder if you’re overcharging. This guilt or lack of confidence creates a lack of alignment, which makes it hard to ask for this price and deliver your service confidently at this price.

Your “Feel Great” Price: You feel well-compensated and confident about your value. Goldilocks would say this price feels “just right”!

Your “Feel Good” Price: You wouldn’t mind making more, but you feel you are competitive. You’re comfortable charging customers this much, though you might wish you made more. This might be a price you once felt “great” about, but now it might feel a bit like “settling.”

Your “Bottom Line” Price : In businesses where you may be “bidding” or negotiating for work, there may be a gap between what you’d like to make and a lower number that you’d still happily work for. It could also represent pricing you use for advertised specials to attract new clients, reward repeat clients, or fill gaps during “the slow season.” This is the price you’d regret NOT doing the work for, your bottom line. It’s important to “know it and don’t go below it!”

Your “Regret Price”: You resent doing the work for this amount and would regret even taking the work! It’s out of alignment and out of integrity for you to work for this price, and frankly, you’re preventing higher-paying customers from hiring you if you charge so little you regret it.

It’s essential that you feel good about your price. But you may have a “range” of prices that feel acceptable to you. Identify your “bottom line price,” your “feel good price,” and your “feel GREAT price.” (Perhaps that’s the price you’re moving towards charging. If so, why not ask for it with your next new client?)

If you’d like to make more, increase the value you feel you deliver, or increase your ability to receive an amount of money that potential clients will be willing to pay.

Earning “What You’re Worth”

When I hear people talking about “earning what they’re worth,” I can’t help but think of a phrase I’ve heard: Our Results Reveal our Intentions. The truth is, we DO earn what we’re worth – what we FEEL we’re worth. If we felt we were truly worth more, we wouldn’t settle for less.

As Maxwell Maltz, author of Psycho-Cybernetics observes, it’s very difficult to outperform our self-image. That’s why personal growth often translates directly into income growth. As we feel more confident about ourselves, we’re able to charge more.

Know Thy Value

In addition to the price you are comfortable with, consider as well the RESULT for the client. What benefit will they receive, and what is that benefit worth to them? Some high-earning friends of mine raised their prices when they realized how much they were making (or saving) their clients!

I know a bottom-line consultant that would give a client a choice between a large fee and a percentage of their increase in profits. The clients would typically look at the large fee and say, “No way!” and opt for the percentage instead, certain that his assistance didn’t warrant such a high fee.

What the clients didn’t realize was that the large fee was intended to scare them into going with the percentage payment instead! Since he was a great consultant who would help them increase their profits by millions, he knew that he would make more money by getting a percentage rather than the flat fee!

They paid him more in the end, but it might ultimately be considered a win-win. The company chose the compensation that felt “lower risk” to them, the consultant helped them make a fortune, the consultant made a mini-fortune, and everyone was better off. All because he knew not only his worth, but his value to his clients.

Pricing Strategies, Pricing Wars

That story also demonstrates the possibility of offering more than one pricing strategy. You can charge by the hour, by the job, or other ways. You might alter what you charge according to when they pay (I offer a 10% discount for people who want to prepay 3 months of coaching). You might charge extra if they want to make payments, or if you have to bill their insurance company.

You might consider offering incentives to your best clients who hire you repeatedly. (Remember how fun it is to get that “11th latte free” after your punch card is full?) Repeat customers are the backbone of a business, and you don’t have to generate the same cost or effort marketing to a repeat customer than a first-time customer.

Your pricing might also be affected by “what the competition is charging” or market conditions – are your services in demand, or are you lonely for clients? Ultimately though, you won’t serve yourself if you underprice out of fear or scarcity. (You might even lose clients who think your services are inferior to a competitor who charges more.)

If you decide to use “discounting” as a marketing strategy, a thank-you to past clients, or an incentive for referrals, new clients, etc., make sure that you are not discounting out of fear and scarcity, but out of a strategic plan. If your “introductory specials” tend to lead to new clients, and if the worth of a new client (over time) is thousands of dollars, it may make sense to knock $50 or $100 off the first appt. or service. But if the new “discount customers” tend not to return, then it’s a strategy that doesn’t work for your business (or you).

It’s not always best to be the cheapest, and if your services or client results go “above and beyond”, don’t be afraid to price above and beyond! It is always better to build value and emphasize your uniqueness than to compete on price alone. The “winner” of the price war isn’t a winner at all if they regret taking the job. Plus, the price war winner becomes a loser the moment another business undercuts them. Most businesses find the value-conscious customer is a better and more loyal customer than than a price-sensitive buyer.

Recognize that only YOU can be responsible for trading your time or services for a price that seems fair to you.

Years ago, I coached a woman who felt she had gotten the raw end of a business deal. She felt taken advantage of, she felt discouraged and angry. In the same conversation, she mentioned how cheap the rent was where her business was located. I asked if it was under market value; she said yes, it was. I asked who was responsible for setting the rent and making sure the rent was “fair.” She said it was the landlord’s responsibility to charge “enough” to cover his costs and assure his asset was producing adequate cashflow. Even though she felt her rent was “cheap”, she wasn’t going to complain!

Likewise, it was her responsibility to do her due diligence on her own rental space, investments, and business deals. And it was her responsibility to negotiate (or walk away from) a deal that wasn’t fair or didn’t make sense for her, and to feel good about her profit. She couldn’t expect someone selling her something to represent her best interests any more than she would insist her landlord accept higher rent!

Similarly, don’t wait for your clients to pay you more if you’re undercharging. Only you can decide if “the price is right.”