Free Yourself from the Money Trap!

What the #FreeBritney movement teaches ALL of us about money.

My friend Kim Butler has said, “Financial freedom isn’t about how much MONEY you have, it’s about how much FREEDOM you have with your money!”

In a similar vein is the saying, “It doesn’t matter how much money you MAKE… it’s how much you KEEP!”

If you ever wondered about the truth of those statements, just look at the the #FreeBritney movement.

A success story gone wrong.

Pop culture icon Britney Spears has sold over 100 million albums. She was the highest paid female musician of both 2002 and 2012. Her residency in Vegas earned more than $100 million. Her multiple tours brought in a whopping $570 million.

Pop culture icon Britney Spears has sold over 100 million albums. She was the highest paid female musician of both 2002 and 2012. Her residency in Vegas earned more than $100 million. Her multiple tours brought in a whopping $570 million.

Britney is also the highest grossing female artist in terms of merchandise. In addition to music merchandise, her perfume brand (launched with Elisabeth Arden) has sold more than $1.5 billion.

And yet… this multi-millionaire celebrity controls virtually NONE of her own fortune. Decisions are made for her. And shockingly, her entire net worth of $60 million is only slightly higher than her ANNUAL royalties—from perfume alone.

Britney only has access to a modest allowance of $2000/week—a tiny fraction of what her father, Jamie, the self-appointed head of her conservatorship, pays himself. And there are many others on Britney’s payroll, which he controls. To add insult to injury, she must pay lawyers on both sides to fight the conservatorship.

The situation is a glaring example of “financial freedom” gone very, very wrong. Britney is a cash-generating phenomenon, yet others who may not have her best interests in mind are reaping the benefits.

In this case, the crimes and abuse go far beyond financial. BIG changes are clearly needed to right the wrongs.

But what about the rest of us? When it comes to money, how do we give our power away? Whose hands are in YOUR pocket?

You’ll earn more than you think.

You’ll earn more than you think.

Most people are surprised to realize they may earn multiple millions over their lifetime. Do you earn six figures? You might bring in $5 million—or more—in total income. Even a modest $4k/month salary would net you more than $2.1 million over 45 years.

However, earning money is of limited use if you don’t KEEP it! And here’s the rub: as in Britney’s conservatorship, there are forces waiting to take control of every dollar before it ever reaches your checking account.

THIS is how the average American can earn $2 million and end up close-to-broke after a lifetime of work. We give up control of our dollars.

Let’s look at who and what we are surrendering our power to… and what we can DO about it!

Banks and other Lenders.

Often from a young age, we are taught to put our money in a bank account. Banks are you friend, right? Well, maybe.

Often from a young age, we are taught to put our money in a bank account. Banks are you friend, right? Well, maybe.

Banks make it convenient to store money and make transactions. They pay you a tiny bit of interest. They help you build your credit. They earn your trust, then they cash in. Their real goal is for YOU to pay THEM interest… a LOT of it!

They throw credit cards at college students like candy… Hoping to lure them in and get them hooked. They “finance” new clothes, take out food, the latest tech and furniture.

You’ve heard the term “predatory lenders.“ While that term generally refers to the most egregious actors, the fact is, ALL lenders are on the hunt for people who will pledge the dollars they have yet to earn.

Interest rates of 18%/year or more are common. If you have poor credit, expect to pay 24%/year interest… or more.

Have bad credit? Capital One has a deal for you… Their “secured MasterCard“ will charge you only 26.99% interest… on your own money!

If you manage to escape credit card debt, you probably won’t escape car loans.

“What monthly payment are you comfortable with?“ asks the salesman on the car lot. You think you’re buying a car, but actually, you are being sold a loan.

This is not necessarily a bad thing. After all, most people need transportation. But at what price? The average monthly car payment in the US is now $563 for new vehicles. Add insurance, maintenance, and fuel, and total car ownership will run you about $800/month, reports AAA.

On the bright side, most car loans have low interest. They are surprisingly efficient. On the downside, what’s the opportunity cost of not investing MORE? It’s astronomical. Many people could become millionaires by simply investing HALF of what they spend on cars! Depreciating assets drain your wealth, appreciating assets grow it.

The Rent Trap.

The rent trap is real—and it’s literally costing millions their financial freedom.

The rent trap is real—and it’s literally costing millions their financial freedom.

In study after study, the analysis is clear… long-time homeowners end up with MANY times more wealth than renters.

As a former realtor and loan officer, I’m very familiar with the moment a homebuyer sees the Truth-in-Lending disclosure and gets a little woozy. (This is the document that shows how much interest they will pay with a 30-year mortgage.)

Their eyes get big as they see that their $300,000 house may actually cost more like $500,000.

But THIS isn’t the scary part!

What’s more frightening is what happens if they DON’T purchase the home. They will probably pay that $500,000 anyway… And end up with NOTHING.

I’ve met plenty of senior citizens who have trouble finding affordable housing. Often, they are forced to move when a landlord raises the rent or decides to sell.

In contrast, I’ve never met a senior citizen who regretted investing in real estate when they were younger. Most self-made millionaires invest in real estate and attribute a portion of their wealth to it.

The truth is, a home that costs $500,000 for (including interest) will probably be worth $1 million or more by the time the mortgage is paid off. And when you OWN a home, you can sell it, rent it, live in it or borrow against it. Ownership equals control.

Taxes: The Government’s Dollar Trap.

Taxes are one of the biggest expenses you will ever pay, especially if you earn a better-than-average income.

Taxes are one of the biggest expenses you will ever pay, especially if you earn a better-than-average income.

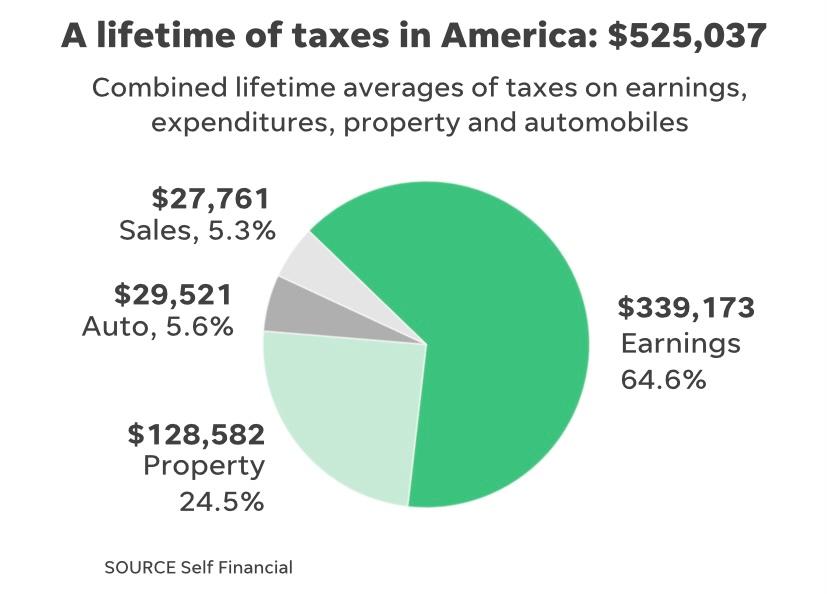

Americans will pay a shocking average of $525,037 each in taxes throughout their lives, according to Self Financial, a financial technology company. Analyzing data from the Bureau of Labor Statistics, Self Financial broke down where this money goes (see chart below).

Tax on earnings accounts for nearly 2/3 of the total, with the average American paying $339,173 in a lifetime.

Now, you might think, “But nothing can be done about taxes, right?” Few people argue with the saying, “nothing is certain except death and taxes.”

However, we CAN take steps to REDUCE unnecessary taxation. Owning a home, owning a business (even a side hustle) and taking advantage of a Roth IRA and life insurance are good strategies.

But be warned: the biggest “tax break” most Americans think they are getting is not a tax break at all!

“Max out your 401(k) then your IRA” may be the most popular financial advice EVER. It’s so common that it is rarely questioned! But is it GOOD advice!?

The truth is, one of the biggest beneficiaries of your retirement plan is the GOVERNMENT. Yes, your retirement plan will provide a substantial stream of income for years to come… for Uncle Sam! Let me explain…

The income tax on the money you “save” in a traditional retirement plan doesn’t go away—it is only DEFERRED. You only reduce taxes now by kicking the can down the road.

Instead of paying taxes on the “seed” (the initial amount invested), you will eventually owe taxes on the “harvest” (the amount it grows into).

You also give up a potentially lower tax rate, since you’ll pay income tax on retirement disbursements, rather than a (typically lower) capital gains tax rate.

Assuming your retirement account grows over time, you’ll actually pay MORE in taxes. And instead of paying taxes when you have steady income, you’ll be forced to pay the taxman after you have retired, when it may be more difficult and/or when tax rates may be higher.

The Consumer Addiction.

Surely you’ll SAVE whatever you don’t spend on housing, groceries, transportation, taxes and healthcare… Right!?

Surely you’ll SAVE whatever you don’t spend on housing, groceries, transportation, taxes and healthcare… Right!?

The truth is, there exists an endless array of businesses and marketing tactics dedicated to separating you from your money:

- The latest fashion.

- The can’t-miss event.

- Subscription memberships and apps.

- The convenience of being cooked and bartended for.

- And everything you think you need to be desirable.

The list of consumer goods is never ending. And a tireless army of advertisers, influencers and behavioral economists work full-time to keep you spending!

Now, I love spending money as much as the next person. I enjoy eating out, I love to travel, and I don’t advocate a life of deprivation for anyone.

But here’s where consumerism has led us astray: we have lost our ability to differentiate between “wants” and “needs.” Do you like that thing, or do you need it? Does it fulfill a dream or true desire, or is it simply a whim or a convenience?

When we learn to prioritize what truly matters to us and align our spending with that, our lives become infinitely more fulfilling!

FAMILY.

Even if you’re not Britney Spears, families can create big challenges with money and BOUNDARIES.

Notice if these situations are happening to you:

- A spouse or partner does not share your financial goals or values, causing you to take on more responsibility than you wish.

- Siblings, parents, or adult children or find themselves in financial emergencies and call YOU to bail them out!

- Inheritance wars: family members are battling over money or property.

Clear communication, boundaries, and proactivity can often make a difference. Financial therapists can be helpful, too.

Take Your Power Back!

I’m rooting for Britney Spears to get back control of her own assets and her own life decisions. I believe what has happened to her is criminal abuse.

But honestly? I can’t help Britney. I can only root from a distance and hope she is now using her power to help herself. She has shaken off the shame of her situation and is using her voice to speak up, loud and clear. I pray she is getting the support she needs.

However, I CAN help thousands of others. I may be able to help YOU, if you desire my assistance.

Is it time to rewrite YOUR money story? Is it time to free yourself from past experiences that left you disempowered? Is it time to free your money from the creditors and predators who seek to control it?

Britney demonstrates for all of us: ANYBODY can lose control of their assets, income, and financial future… even a multi-millionaire celebrity. She is also pointing the way home:

Speak the truth.

Britney has shaken off YEARS of shame as her situation has devolved into a nightmare. No longer afraid to speak up, she is coming clean and spilling the beans. She is saying what she wants and what she will no longer tolerate.

Have you spoken the truth about money in your life?

Stop what’s not working.

Britney has announced she will not perform again until she is free from her conservatorship. She is refusing to be the cash cow for those who control her assets. She’s done with silence and she’s done with surrendering her autonomy.

What’s “not working” for you?

Get support.

This has been especially difficult for Britney, as the conservatorship has made it difficult to choose her own advocates, from therapists to lawyers. But it is now clear, she will not be stopped by previous limitations. Her commitment to a new outcome is now far more powerful than her past.

Where do you need support?

Are you ready to chart a different course?

What is the new outcome YOU are committed to? Decide now to:

- Speak the truth about money

- Stop what’s NOT working

- And get the support you deserve!

If you are committed to a new financial outcome, a great place to start is “ReWrite My Money Story.” This is a live, small-group course designed to change your financial destiny.

If you are committed to a new financial outcome, a great place to start is “ReWrite My Money Story.” This is a live, small-group course designed to change your financial destiny.

Or you may prefer private coaching, or some combination of group and private work.

I’m offering a private coaching option designed to dramatically accelerate your progress over the next year. To find out more, email me and tell me a bit about your situation. If I feel we may be a fit, we’ll get on the phone to explore working together.

It’s time to free our minds, free our money, and free our future!